What changes can we expect as textile supply chains develop?

Sam Taylor, the founder at The Good Factory discusses the expected changes print businesses can expect as textile supply chains evolve and develop.

There is no doubt that the events of the last few years have put supply chains under considerable pressure. The decade after 2010 had lulled us into a false sense of security around our ability to produce more under shorter timelines and at lower costs. It was a boom period. Post the 2008 financial crisis productivity was the word that determined our direction. And while many proclaimed that, post Covid-19, efficiency was going to determine how we made the best out of our supply chains, 3 years after the first lockdown and our supply chains are still in a precarious position, even if we can sometimes have a few smooth months. Part of our problem in grasping the complexity of global forces on our supply chains is partly down to the fact that so many of us have never experienced so many crises all at once: climate change, a cost of living crisis, war with a main energy producing country, political polarisation etc.

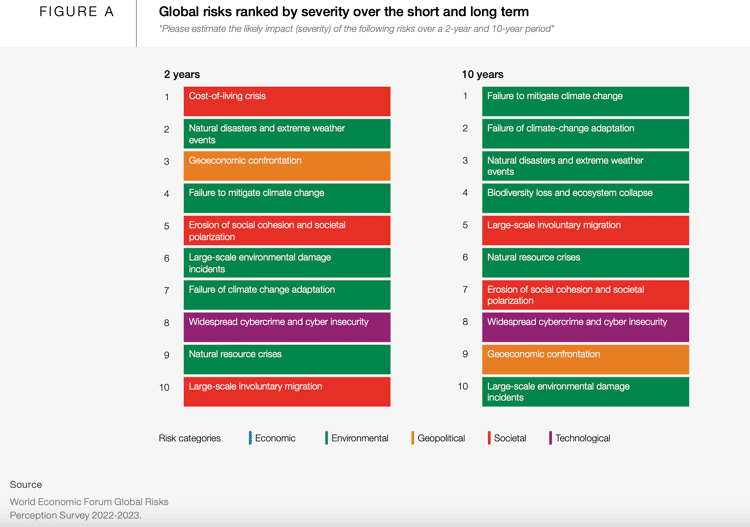

The introduction to the World Economic Forum’s Global Risks Report states, “as 2023 begins, the world is facing a set of risks that feel both wholly new and eerily familiar. As we stand on the edge of a low-growth and low-cooperation era, tougher trade-offs risk eroding climate action, human development and future resilience.” The 2023 Global Risks report (written in conjunction with the Zurich Insurance Group), ranks the top 10 global risks by the severity of the impact over the next 2 and 10 years.

With the textile industry being so globally connected, what effects one will effect many. Especially with new legislation coming out of the EU, and US States bringing in individual legislation, to reduce the environmental and personal heath implications of climate change and increased chemical production. While moving the entire industry to sing from the same hymn sheet is unlikely in the short term, smaller, leaner and more specialist production is an easier short term solution.

While near-shoring has been spoken about as a never materialising trend since we started offshoring, large-scale involuntary migration is likely to be the catalyst that drives that trend to realisation. Especially with large textile producing countries such as Bangladesh, Pakistan and India being at the forefront of the climate change catastrophe. While it’s easy to look at the political rhetoric coming out of the Global North and think that this effects us through the rise in refugees, what is not mentioned is the likely brain drain on our supply chains. Alongside a rise in prices due to higher wages in countries who are less likely to be impacted by extreme weather events. The need to work towards resilient, and fairly remunerated, supply chains has never been so important.

Obviously it’s completely impossible to simply move production from one side of the world to the other, but we’re going to need to learn a whole new set of skills in order to limit financial risk. We need to get serious now about understanding Scope 3 emissions and how we’re going to reduce them. I know I speak on behalf of many Asian suppliers when I say; simply requesting a supplier reduces their emissions by X percent without taking into account the impact to their business growth plans, and without providing more financial support, ensures the goal fails before it gets out of the gate. With energy being a key driver of emissions throughout the textile production process, understanding country specific infrastructure and political will has never been a need until now. Sadly it’s not a case of merely switching out to a low carbon fuel source, but also understanding the extraction, conversion and processing of that fuel source as well.

In November 2022 the World Bank warned that India could become one of the first places in the world where wet-bulb temperatures could soar past the human survivable limit. Not the only, the first. Which gives us the need for our other new skills; those of the weatherman. In order to forecast our production from the current just-in-time approach, to actually having it when it’s needed, even if it comes 3 months early. Not only will our ability to plan be tested, but our entire financial structure will need to be redesigned. It’s not viable to simply pay a minimum monthly wage when there will be months a year that it is too hot to work. Technology and smart manufacturing will be what helps factories produce more with limited time resources, alongside getting more out of what we produce. With companies who’ve previously focused on selling more tangible products having to switch to some service products to make up the short fall. The International Energy Agency has highlighted ‘increased material efficiency’ as part of the solution to decarbonisation as important as using renewable resources.

While it’s easy to prioritise the immediate risks over the long term ones, especially when we live in areas not yet seeing the impact of climate change, if we take too long to put climate change and biodiversity loss at the top of our agenda we will lose our ability to stabilise our planetary systems. How we manage that within textile supply chains is to start getting to know our suppliers really well. And your supplier’s supplier. If we fall into the low cooperation era the WEF predicts then we hinder our ability to achieve a liveable planet. There needs to be an agreement of shared goals and an agreed upon pathway from all stakeholders. Perhaps it’s time to take on the advice the American Marketing Association gave in 2019; it’s advisable that your customers, and your suppliers have seats on your board.

For more information about The Good Factory visit here: https://www.thegoodfactory.co.uk/

Topics

Recent news

What are the benefits of print businesses committing to a Net Zero Carbon emissions target?

We speak to Robert Connell, Senior Commercial Sustainability Manager at ClimatePartner who who offer solutions along the net zero cycle to support business’s effort in corporate climate action. In this discussion we discuss the importance and the process and benefits of businesses committing to a Net Zero Carbon emissions target.

6 Sustainable Printing Practices Changing the Game in Textile and Apparel Decoration

The textile industry is shifting towards sustainability. Innovations like waterless and digital printing, eco-friendly inks, and recycled materials are reducing waste. AI and automation optimise production, while circular models promote reuse. Consumer demand for transparency drives this change, making sustainable practices essential for future-focused brands.

Sustainability in Production Print: Advancing Practices in Wide Format, Textiles, and Software

As sustainability continues to take centerstage across industries, the production print sector is making massive strides in integrating eco-conscious practices. From wide format to textile applications, with the growing reliance on advanced production software, the space is evolving to meet environmental goals as well as consumer demand for sustainable products.

Why must the print industry recognise software and material innovation

Laurel Brunner argues that the printing industry must recognise the value of both software and material innovation, and be willing to pay for it. Software, though intangible, drives efficiency and reduces carbon footprints. While materials science currently dominates, R&D costs are inherent in all advancements. Paying a premium ensures continued progress, benefiting the industry's evolution and sustainability.